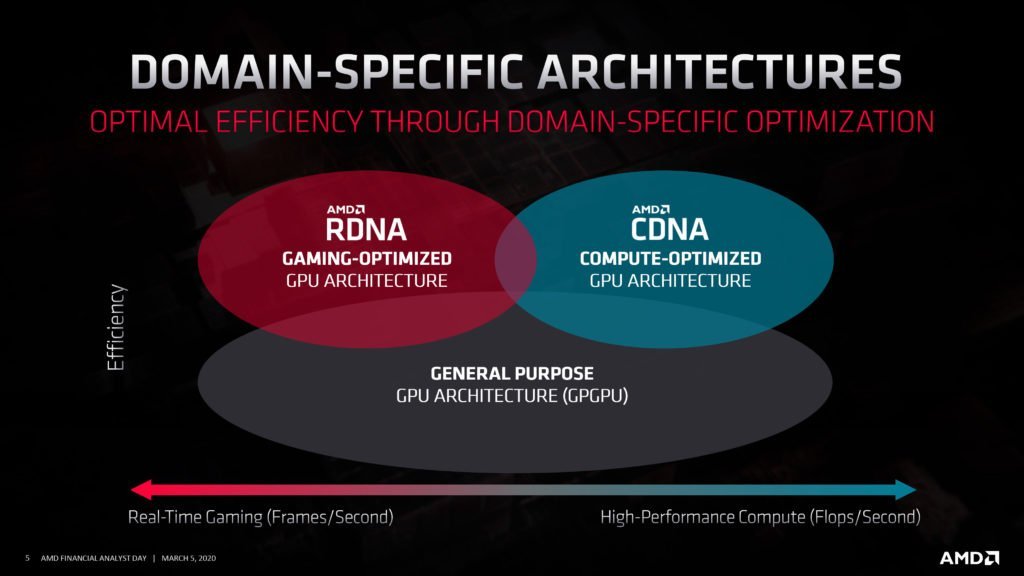

Sadly in that boom, they have been mostly bypassed for AMD. By far the big winner was NVIDIA, who went on to make billions of dollars in the market, which is not to suggest that AMD had no victories for their prior and current generation devices, including the Radeon Instinct sequence. Still, a fraction of what NVIDIA has gained was their slice of that business and its sales. Nevertheless, the fortunes of AMD are set to change quite soon. We do know that AMD (as a provider to Cray) had earned two major supercomputer victories with the U.S.–worth more than $1 billion for CPUs and GPUs–so there were a lot of questions about just what AMD was operating on that transformed the heads of the U.S. government into. As AMD announces today, the solution is their new dedicated data centre computing GPU architecture: CDNA. Compute alternative to gaming-focused RDNA, CDNA is the compute-focused data centre framework for AMD and other applications. As all else that is being discussed at the Financial Analyst Day today, AMD’s announcement here is at a high level. But even at this high level, AMD makes it clear that in their GPU development process there is the fission of sorts going on, which contributes to CDNA and RDNA being their architectures.

This continues to be seen just how unique such systems are (and will be with time). AMD has briefly mentioned that CDNA will have less “graphics-bits,” so these pieces may have minimal (if any) graphics capabilities, rendering them very distinct from RDNA GPUs. So generally speaking, Enlightened is now on a course close to what we saw from other GPU vendors, where compute GPUs are becoming a distinct commodity class gradually, as compared to repurposed gaming GPUs. AMD’s objectives for CDNA are simple and straightforward: construct a family of massive, efficient GPUs which are explicitly designed for general use in computing and data centres. This is a road AMD has already begun to go down with GPUs like Vega 20 (used in the Radeon Instinct MI 50/60), but now with even more optimization and optimization. Of course, a big part of this would be machine learning performance, which involves promoting quicker execution of smaller data types (e.g. INT4/INT8/FP16), and AMD also goes so far as to consider tensor operations explicitly. But this can not come at the cost of conventional FP32/FP64 computation either; some supercomputers that will go into AMD’s GPUs will do a whole lot of high precision maths. So AMD has to do well across the continuum of computation and machine learning, over several forms of data. AMD would still need to boost its performance-per-watt to get there because this is an environment they have often trailed at. Today’s Financial Analyst Day presentation doesn’t go into much great depth on how AMD can achieve that –at least besides the apparent changes in production procedures –yet AMD is keenly conscious of their need for improvement. Though CDNA will also differentiate itself with apps including some stuff that only Enlightened can do, reliability and reliability at an enterprise level will be one leg here while meeting ever-popular demands for virtualization.

The firm is on track to reach double-digit data centre market share by the second quarter of 2020 according to AMD’s Forrest Norrod. Meanwhile, with its Ryzen processors, Radeon graphics and semi-custom products, the company says it is well placed to fuel sustainable development in the Computer and gaming industries as well. AMD has almost doubled all consumer product sales and market share since 2017. It aims to launch the first Ryzen processors based on Zen 3 in late 2020. The Zen 4 core is currently being developed and is oriented towards using 5 nm process technology. Furthermore, the introduction of products based on the next-generation Radeon DNA 2 design is planned in late 2020.